How Clark Wealth Partners can Save You Time, Stress, and Money.

Table of ContentsThe Ultimate Guide To Clark Wealth Partners5 Easy Facts About Clark Wealth Partners DescribedThe Best Guide To Clark Wealth PartnersClark Wealth Partners - An OverviewGet This Report on Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.Some Known Questions About Clark Wealth Partners.

The globe of money is a complicated one. The FINRA Structure's National Capacity Research Study, as an example, recently located that virtually two-thirds of Americans were not able to pass a fundamental, five-question economic literacy test that quizzed participants on topics such as interest, financial debt, and various other reasonably fundamental ideas. It's little marvel, then, that we usually see headings lamenting the inadequate state of most Americans' finances (st louis wealth management firms).In enhancement to managing their existing clients, financial consultants will certainly usually invest a fair amount of time every week conference with possible customers and marketing their services to retain and expand their business. For those taking into consideration becoming a monetary expert, it is essential to consider the average wage and work security for those functioning in the area.

Training courses in taxes, estate planning, financial investments, and risk monitoring can be valuable for pupils on this course. Depending upon your distinct job objectives, you might additionally require to earn particular licenses to satisfy certain customers' needs, such as buying and marketing stocks, bonds, and insurance plan. It can also be useful to make a qualification such as a Qualified Economic Planner (CFP), Chartered Financial Expert (CFA), or Personal Financial Professional (PFS).

Clark Wealth Partners Things To Know Before You Get This

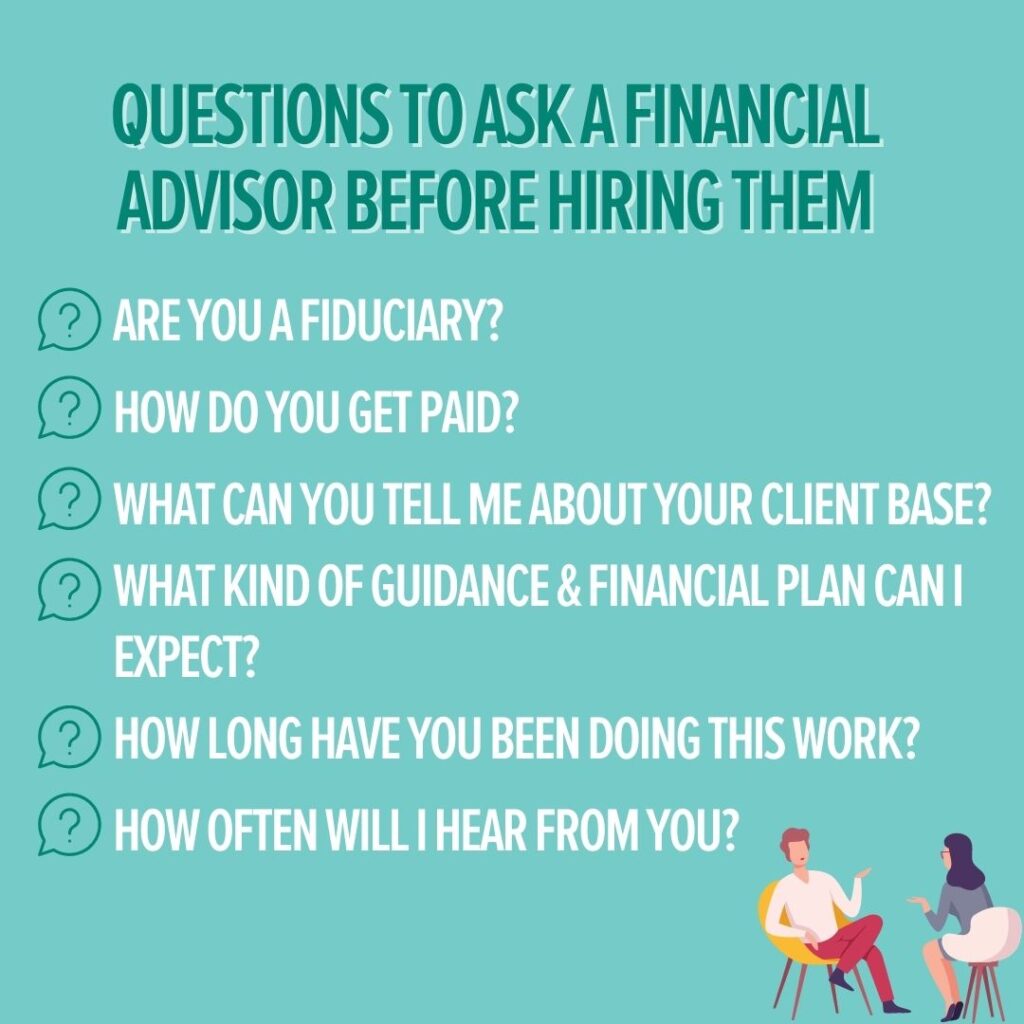

Many people determine to obtain help by using the solutions of a financial expert. What that looks like can be a number of points, and can vary depending upon your age and stage of life. Prior to you do anything, research is essential. Some individuals worry that they need a particular amount of money to invest prior to they can obtain assist from an expert.

10 Simple Techniques For Clark Wealth Partners

If you have not had any kind of experience with an economic expert, right here's what to expect: They'll start by providing a comprehensive evaluation of where you stand with your assets, responsibilities and whether you're meeting benchmarks contrasted to your peers for cost savings and retired life. They'll review brief- and long-term objectives. What's useful about this step is that it is personalized for you.

You're young and functioning full time, have an automobile or two and there are student financings to pay off. Here are some feasible ideas to aid: Develop great financial savings practices, repay financial debt, set baseline objectives. Repay trainee lendings. Depending upon your occupation, you might certify to have component of your college funding waived.

More About Clark Wealth Partners

You can talk about the following best time for follow-up. Before you begin, inquire about rates. Financial consultants normally have various tiers of prices. Some have minimal asset levels and will charge a cost normally numerous thousand bucks for creating and adjusting a strategy, or they may charge a flat fee.

You're looking ahead to your retired life and assisting your children with higher education prices. A financial advisor can provide suggestions for those circumstances and more.

Unknown Facts About Clark Wealth Partners

That could not be the very best means to maintain building riches, particularly as you progress in your job. Arrange normal check-ins with your planner to tweak your plan as needed. Stabilizing savings for retirement and university expenses for your kids can be difficult. An economic expert can aid you focus on.

Believing about when you can retire and what post-retirement years may resemble can create issues about whether your retirement financial savings remain in line with your post-work strategies, or if you have actually conserved sufficient to leave a tradition. Help your financial professional understand your method to cash. If you are a lot more traditional with saving (and potential loss), their pointers need to react to your worries and concerns.

All About Clark Wealth Partners

Planning for health treatment is one of the big unknowns in retired life, and an economic specialist can outline choices and suggest whether additional insurance coverage as protection may be practical. Before you begin, try to obtain comfortable with the idea of sharing your whole monetary photo with a specialist.

Giving your professional a full image can aid them produce a plan that's prioritized to all components of your economic status, specifically as you're fast approaching your post-work years. If your finances are straightforward and you have a love for doing it yourself, you may be great on your own.

A monetary advisor is not only for the super-rich; anyone encountering major life changes, nearing retired life, or sensation overwhelmed by economic decisions can gain from expert advice. This article discovers the duty of economic experts, when you might need to speak with one, and crucial factors to consider for selecting - https://trello.com/c/TV9v5WcI/1-clark-wealth-partners. A monetary consultant is a trained expert that assists clients handle their funds and make informed decisions that line up with their life goals

The Best Guide To Clark Wealth Partners

Compensation versions also vary. Fee-only advisors charge a flat cost, per hour price, or a portion of assets under administration, which has a tendency to decrease prospective problems of interest. In comparison, commission-based consultants gain earnings with the economic products they sell, which might affect their recommendations. Whether it is marital relationship, divorce, the birth of a youngster, career adjustments, or the loss of a liked one, these events have one-of-a-kind economic effects, frequently requiring timely decisions that can have long-term results.